From a very young age, I was taught by my parents to be thrifty, never to spend unessentially and to save as much money as I possibly can for rainy days. I made my first 10 sen when I was 8 years old in 1981 when I sold my homemade book marks to my class mates. When I turned 12, I was allowed to keep the ang pow money that I received during CNY. I also did house chores to earn money from my parents. I’ve never looked back since. The 10 sen that I earned have grown by leaps and bounds over the years. Thus, it’s natural for me to teach my 3 girls to inculcate good money habits from a young age. My girls are naturally pretty financially savvy now that they are teenagers. They think twice or thrice before buying something and only if the item is very cheap. They will give up an offer for a cup of boba milk tea or a lavish meal in exchange for the money and then save up to buy things that they want. They also have an entrepreneur mind – they continuously think of ways to grow their savings via little business endeavors – from selling old story books and pre-loved items to baking cookies and much more.

How Young Should We Start?

It’s never too early to start instilling good money habits to your kids. Start by telling them that everything that they have from food to toys, books, clothes, etc need to be purchased with money. And they have to work to get money. Explain to your kids that it is only through good financial planning that they will have extra money for savings. Explain to them how vital it is to have savings.

Importance of Financial Literacy

About 84,805 Malaysians were declared bankrupt between 2015 and 2019. Based on the figure provided by the Insolvency Department, people below the age of 34 made up 26 per cent of the bankruptcy cases. This is alarming because it reflects that the level of financial literacy among young Malaysians on the ground is still lacking. When someone is being financially illiterate, it will lead to poor financial decisions such as over-utilisation of credit cards and overspending, which end up in low financial well-being as what has been happening to the youth of Malaysia in recent years. This is made worse during the Covid-19 pandemic. Many people were totally unprepared to face the loss of income, whether short term or long term.

Raising Duit Smart Kids In A Digital Era Through HLB Pocket Connect App (With A 3-in-1 Junior Savings Account)

Besides explaining to your kids the concept of money, parents with kids aged 18 years old and below can now set up a 3-in-1 Junior Account for them. This is a joint savings account, open in the parent’s name and the child’s.

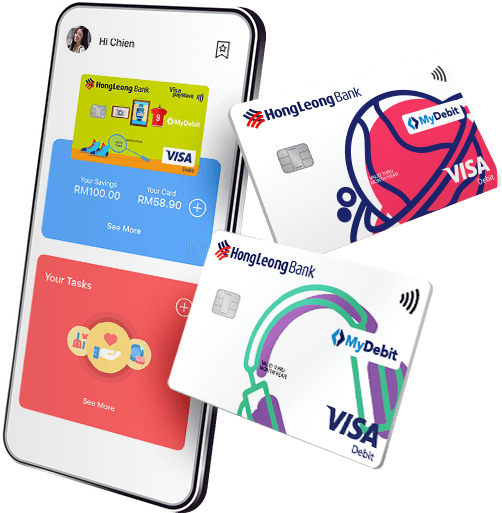

With this account, you and your child can download the HLB Pocket Connect app onto your mobile phone. This is the 1st Pocket Money App In Malaysia, designed in mind with helping parents raise financially savvy kids in a digital era.

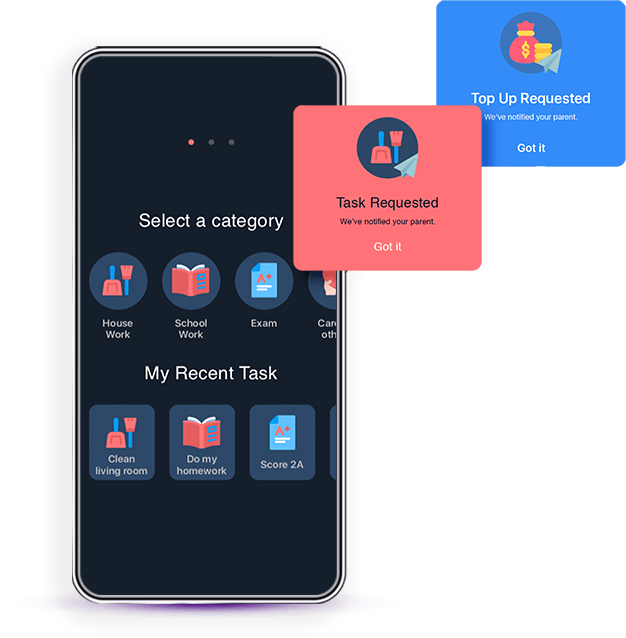

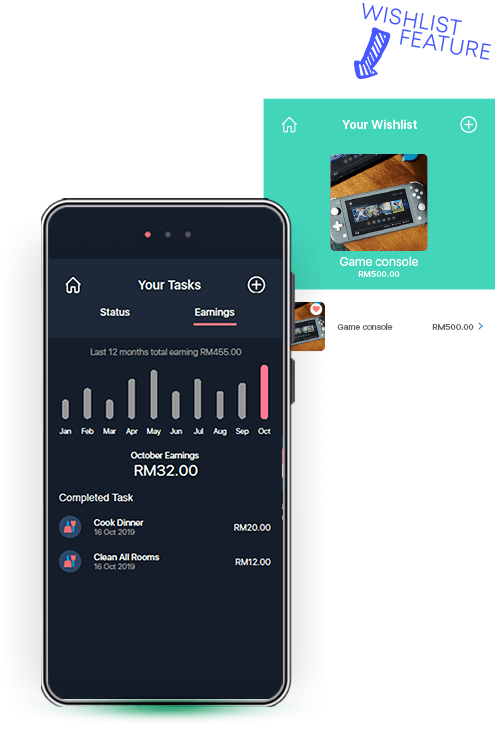

The HLB Pocket Connect app allows you to manage your child’s debit card and money in her savings account. This app allows your child to ‘earn’ and use money. ‘Earning’ money can be by way of helping out in household chores, scoring good grades in school, good behaviour and much more. Each time your child gets a brownie point, you bank in some money into her savings account.

The HLB 3-in-1 Junior Account is the only junior account that comes with a savings account, a reloadable debit card and a high interest FD account. Your child will be given a debit card. These days carrying a debit card is safer than cash. Money can be auto reloaded for free from the Junior Savings Account in multiples of RM50 up to a maximum of RM500 per month when the balance in Junior Debit Card (Re-loadable) falls below RM50. Alternatively, reload any amount at any Hong Leong Bank branch for a nominal fee of RM2.

This mobile app is designed to help parents teach their children good money habits, in a fun, interactive way. Once your child knows the power of money, she will be motivated to earn it and see her savings account grow. She can also buy things that she wants using the debit card. Don’t worry about your child over-spending as you have the ability to monitor her debit card transactions online, set a withdrawal limit, retail purchase limit, online purchase limit and auto-reload limit via the Hong Leong Connect or their branches.

With the HLB Pocket Connect App, your children will be able to keep track of their pocket money and spending, while having the freedom to go cashless with their very own HLB Junior Debit Card. Your child will learn to earn, spend and save responsibly while they manage their pocket money with HLB Pocket Connect App.

With digitalization being the norm now, it is imperative that your child gets a head start in learning how to earn and spend digitally. The HLB Pocket Connect App empowers parents to inculcate good money habits in their children from a young age. Being financially savvy is as important as learning Math and language as this will help your children to be a good manager in managing their finances throughout their years.

The Hong Leong Bank 3-in-1 Junior Savings Account can be applied at Hong Leong Bank. For a limited time only, you’ll be rewarded with a RM38 Shopee voucher with the opening of a HLB 3-in-1 Junior Savings Account.

To apply, visit any Hong Leong Bank branches and bring along:

Children’s birth certificate and MyKid.

Parent or legal guardian’s MyKad/passport.

Give your children a good head start in managing their money wisely and they will thank you for it one day.

No. of times viewed = 49

Follow

Follow